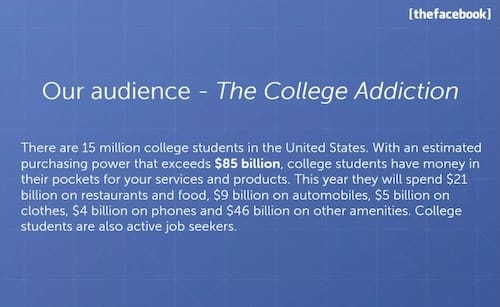

A business needs a market to grow. Figuring out how big that market could be and what it’s like is super important when you’re starting out. This info will help with things like your goals, product ideas, and how you pitch to investors. Just look at Facebook, now known as Meta. Back in the day, social media was pretty much a new thing. Facebook, then called TheFacebook, had to show there were real people interested in using it. Here’s an example from their early pitch:

It makes a solid point, right? If Facebook hadn’t created a great proposal early on, it might not have attracted the investment to grow into what it is today. So how did they pull off those numbers and how can you do the same for your startup? The trick to getting there lies in three terms: TAM, SAM, and SOM.

What are TAM, SAM, and SOM?

TAM (Total Addressable Market) is the big picture of how much money a business could make if it captured the entire market with zero competition.

SAM (Serviceable Available Market) is the slice of that market that your products and services can actually serve.

SOM (Serviceable Obtainable Market) is about the real part of the market that you can realistically capture. These ideas are all linked and are usually shown as three overlapping circles, with SOM inside of SAM and SAM inside of TAM.

Out of these three, we start with TAM since it’s the foundation:

Total Addressable Market (TAM)

TAM is an ideal number showing the maximum revenue a business could make in its space, assuming it turns every prospective customer into a buyer paying top dollar. This number helps gauge how big a business could get, but chasing after it is not a practical target. Unfortunately, you’ll never hit the TAM mark because it assumes you would have no rivals, and that’s just not realistic—there’s always competition, even if you come up with something brand new.

How to Calculate TAM

There are a few ways to figure out your TAM:

Top Down Approach: This method involves looking at industry reports and market studies. Research firms like IDC and Gartner publish info about market sizes. You can compare this data to your business goals to understand the potential size of your offerings. Just remember that not all data will perfectly fit your needs, and big companies often have the resources to pay for fresh research, while most startups make do with broader data sets.

Bottom Up Approach: Here you look at past sales data and pricing. First, find out how many potential customers are in your market, then multiply that by how much you expect to earn from each one. For example, if you sell medical software for $1,000 a year and there are 1,352 hospitals in Australia, your TAM would be $1.35 million.

Value Theory Approach: This more subjective method is good for those in innovative spaces or who haven’t launched a product yet. It’s based on how much customers might be willing to pay for your product’s value. Instead of just looking at average prices, focus on what competitors charge and add any extra value your unique features offer. So, if your medical software is the first with cloud access, think about how much extra hospitals would pay for that convenience.

Serviceable Available Market (SAM)

SAM gives you a clearer picture of what you can actually sell. It reflects that no product can serve the entire market.

How to Calculate SAM

To figure out your SAM, build on the bottom-up method used for TAM. Here’s where you realistically gauge how much of your product can reach customers. Most founders wish their product could reach everyone, but that’s hardly the case. For instance, if your product works best for public hospitals, focus your SAM on that sector. If there are 695 public hospitals in Australia and each pays $1,000 a year, your SAM would be $695,000.

Service Obtainable Market (SOM)

Lastly, we have SOM, which is the actual piece of the market your products hit after you launch. It’s crucial for evaluating your startup’s potential.

How to Calculate SOM

You should start figuring out your SOM once you’re in the market with some customers. Take last year’s market share and multiply it by this year’s SAM. For example, if your market share is 58% and the new SAM is $715,000, your SOM would be about $414,700. If your sales exceed this, you’re growing; if not, you may need to understand why your competitor is doing better. Keep in mind, SOM is zero before you launch, but you can still make educated guesses about potential market share—it could help when talking to investors.

Why are TAM, SAM, and SOM Important for Startups?

For a startup, TAM is key because it tells a story that can get investors interested. They usually look for a “just right” TAM. Too big and they worry about oversaturation; too small and it’s not worth their investment. A good TAM encourages investors because it shows potential for growth. If you’re in a niche market, you’ll need to find ways to expand your TAM—like targeting new industries or going global.

Tips for the Perfect TAM Slide

For many startups, the TAM slide is crucial during pitches—it leaves a lasting impression. Here are some tips for making it effective:

- Prefer Bottom-Up Calculations: Investors like real insights, so a bottom-up approach shows you understand the market better than just digging things from Google.

- Avoid Overhyping Values: If your product’s for Gen Z, don’t throw in figures for millennials. Your TAM should focus only on your targeted audience, not the broader market.

- Clarify Geographic Focus: If you’re not aiming for international markets, make sure your TAM clearly reflects that.

- Prepare to Justify Prices: If you haven’t started selling yet, estimate the average selling price carefully. While you don’t need to show calculations on the slide, have them ready to explain if needed.

- Think Ahead: Talk about how your TAM can grow with your product over time. Look at Facebook, which started as a college network but evolved to include a much bigger audience.

Resources for Finding Market Size

While hiring firms for market research is an option, entrepreneurs should try their own research too. It helps build a deeper understanding of the market and how their business fits in.

- Online Research: Different industries have analysts tracking performance. Their data can help you understand market trends and past performance.

- Financial Reports: Looking into how your publicly-traded competitors are performing can help you set realistic goals for your business.

- Talk to Experts: Sometimes data isn’t enough. Engaging with seasoned professionals can give you insights on specific market segments and potential customers.

- Market Research Tools: Plenty of online tools can help you compare businesses, see what keywords customers use to find them, and learn about online visibility.

Final Thoughts

While TAM, SAM, and SOM are important for startups, especially in tech, keep in mind that the initial TAM might look small for innovative ideas. If you’d calculated the TAM for companies like Google or Amazon at their beginnings, it wouldn’t have been significant. But as they grew, so did their reach. In short, the TAM is crucial for sharing your vision, but it won’t guarantee success or limit your potential for growth.